By Charles Pence

As the demand for new construction in Santa Monica continues to grow, developers and buyers must be aware of the challenges that come with this high-demand market. From increased transfer taxes to finding creative ways to maximize living space, navigating these hurdles requires detailed knowledge of the local regulations that I aim to explain in this article.

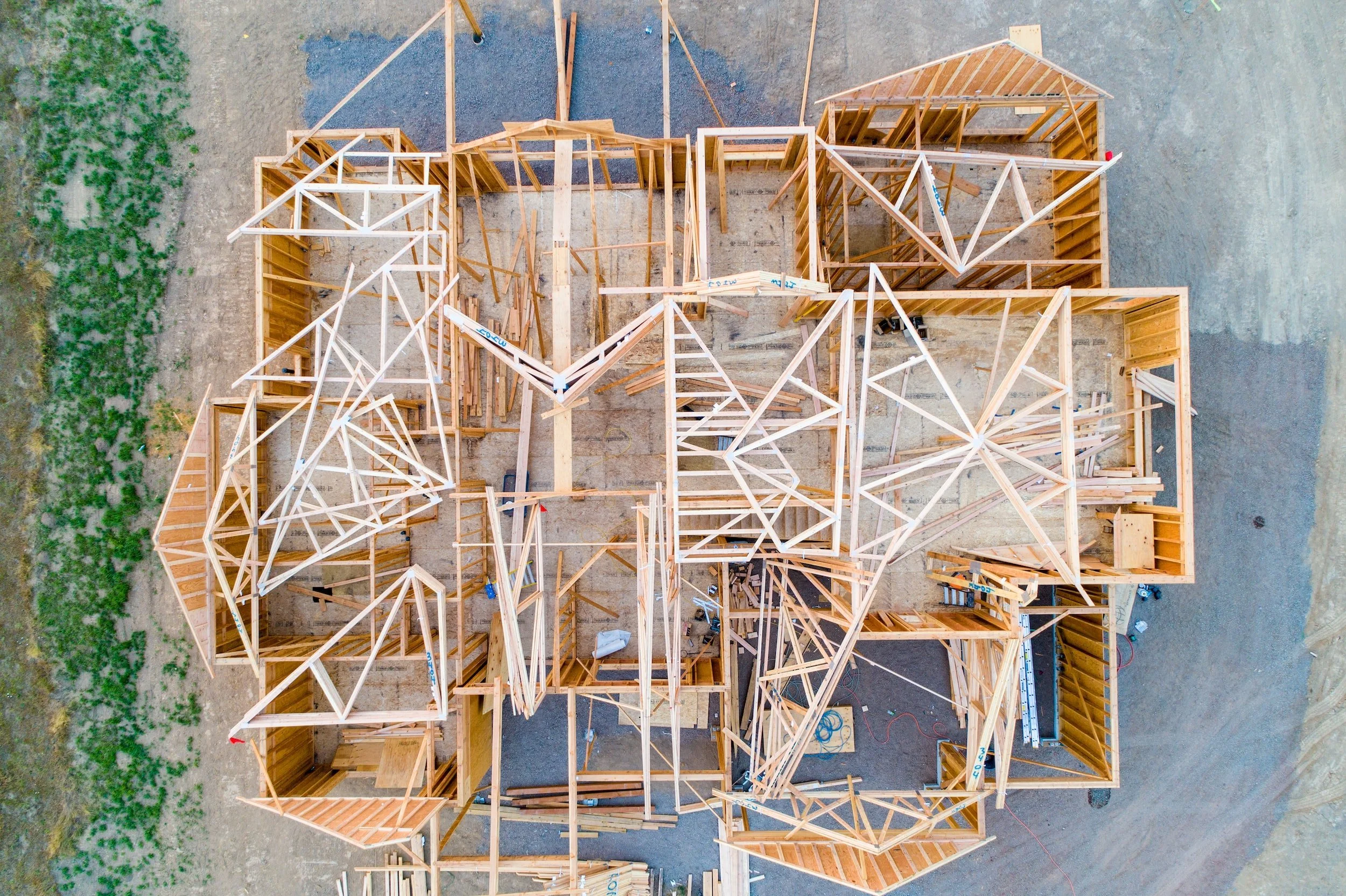

The continued high demand for new construction comes with its own issues and concerns, not just for developers but homeowners who are contemplating building that dream home. Developer costs associated with building and selling a new home just keeps inflating, costs that are then offloaded onto prospective buyers.

The cost of land has not gone down at all either, remaining consistent over the last few years as builders still have to compete with people looking to build their own starter homes. On top of all of that, one local developer recently told me that the overall increase in construction costs on the Westside for the more luxury homes is up by $200-$250+ per square foot over the last couple years alone (the cost of just lumber and concrete are up 70% and 30% respectively).

Further, the new “Monster Mansion” building codes have been enacted in both Santa Monica and Los Angeles. These new codes have dramatically reduced the square footage of the home that is above grade (the basement area hasn’t changed…yet. There is talk in both cities of including the basement square footage in the total allowable square footage which would be catastrophic!). Under the latest ordinance in Santa Monica, the square footage above grade was reduced by about 26% (again, not counting the basement living space). Under the new Hillside Ordinance, hillside lot codes are much more restrictive. To further reduce home sizes, Santa Monica no longer allows the combining of multiple lots, thus “zoning out” the ability to build a larger home.

Speaking of larger houses, another consequential code change is the building heights, which, in some cases, have been reduced by four or more feet. This creates a problem if you want to have a peaked roof on a traditional house while still maintaining high ceilings. I think that’s why we will see more architectural and modern homes with their flat roofs in the future. A flat roof allows for a higher ceiling which increases the volume inside the house. We are also seeing in these modern interiors, fewer walls between public rooms. The net effect of an open living, dining, family room and kitchen as a continuous open space, along with 12+ foot ceiling heights and expansive glass doors leading to outdoor entertainment areas, is that it gives the emotional feeling of a much larger, dramatic, living area. This design, with the volume and openness gives the illusion of a much larger space than a “traditional” home. This will be one of the ways developers will make up for the reduction in square footage.

Then FINALLY, the impact of the massive new City Transfer Tax increases is yet another new concern. In Los Angeles, a home that sells between $5M-$10M is subject to a 4% transfer tax. If the property sells for $10M or more, the transfer tax is 5%. Santa Monica enacted a similar transfer tax that is triggered when a property sells for $8M, or more. For example, in Santa Monica, if a property sells for $7,999,999 the transfer tax is $22,000. If it sells for just one dollar more- $8,000,000, the transfer tax is $443,000 plus an additional 5.6% for the amount over $8M. The start dates for these new taxes was April 1, 2023 in Los Angeles and March 1, 2023 in Santa Monica.

So what does all this mean?

What challenges faces developers and buyers interested in new construction?

Despite the challenges and high costs, new construction remains very much in demand. The dramatic increase of wealth on the Westside of Los Angeles has created a much larger buyer pool for new construction homes, and even with new restrictions and costs, builders haven’t been able to keep up with the demand. One of the effects of this demand has been the pre-sale of many homes that are still under construction; where buyers will make an offer to secure the home before it hits the open market. This also allows the Buyer to make customizations to suit their specific needs and aesthetic. This can be an excellent strategy for Builders and Buyers alike and an experienced realtor can help locate a pre-completion sale opportunity and navigate the intricacies of the process- saving everyone time and money along the way.

Developers will have to get more creative designing living spaces to make up for the smaller homes. They must continue to find ways of integrating the lower basement level into primary living areas like home theaters, gyms, wine cellars and tasting rooms, extra bedrooms, informal family or playrooms for kids. On the first floor we will see more wide open spaces with high ceilings, elevators and the elimination of the formal living room to accommodate larger kitchen-family room combinations and/or a convertible den or office. We will also see more balconies and outdoor or rooftop decks for added “outdoor living” space.

We will definitely see more ADU’s and Junior ADU’s (Additional Dwelling Units). The State of California’s mandate for more housing led to the state creating legislation allowing for additional dwelling units in R-1 neighborhoods. Depending on the size of the lot and the municipality, a homeowner can add up to 1,500 square feet of livable space on their property including converting the garage. In Santa Monica for instance, a Junior ADU, maximum of 500 square feet, can be added to an existing dwelling with direct access to the home as long as it has a private entry. An additional standard ADU can also be constructed on the property or a detached garage converted (they can not be attached to the house). The square footage of these additions or separate structures do not count against the allowable square footage for the house. Another option for homeowners or developers is to consider major remodels as the allowable square footage is higher than for a total demolition and new house build.

Overall, Santa Monica has seen a surge in new construction demand due to the influx of wealth on its west side. Despite increasing taxes and restrictions, builders are unable to keep up with this high demand. Developers have had to get creative when designing living spaces for smaller homes while homeowners can take advantage of ADU's or Junior ADU's as an option for extra livable space. It is important that buyers work closely with experienced realtors like myself who understand how to navigate the complexities of pre-construction sales opportunities and major remodels so they can make informed decisions about their investments in santa monica properties. With these strategies, Santa Monica will continue to be an attractive destination for those looking into purchasing property in one of California’s most desirable locations.